Headlines tragically remind us quite frequently that many aspects of our lives have become unavoidably dangerous. Sadly, this danger is due to the whim of individuals and access to weaponry. The deadly risk is the “active shooter incident.”

An active shooter incident describes a situation in which at least one person is actively killing or attempting to kill persons in a populated area. Naturally, as we are referencing a shooter, such incidents involve firearms.

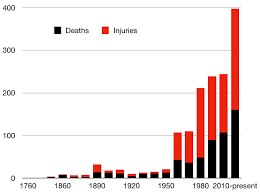

Active shootings are becoming more common. Studies made by the FBI between 2000 and 2015 indicates annual mass-shooting events rose from 6.4 per year to 20 per year. Studies also show that most shootings take place within a business or school (educational) environment. The frequency of shootings is accompanied by, on average, an increase in the number of persons killed or wounded per event.

As with any other risk that becomes significant, it is very important to find a strategy to deal with active shootings. Insurance is among the tools helpful with both pre- and post-incident planning. However, much uncertainty exists regarding protection for active shooter losses.

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.

Confusion may also be caused by insurance policies via the silent coverage problem. An insurance form is considered silent when it neither specifically names nor excludes a source of loss, such as shootings. It can be chaotic during the time it takes to clarify coverage gaps.

The insurance sector has a reputation as being slow to react to change. Of course, speed is never at the level that most would wish when new coverage issues arise. However, the insurance market has been stepping up and addressing the serious active shooter exposure. While there is the option of trying to amend standard policies to add protection, other ways that coverage is being addressed are separate policies that supplement insurance protection with a variety of services.

Please see part two for more information on this issue.

COPYRIGHT: Insurance Publishing Plus, Inc. 2018 All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions