Standards must met the requirements of ASME/ANSI or ASTM

Operated by or for the Federal Government for the benefit of the Armed Forces and their dependents

TruePoint Insurance is one of Georgia’s fastest growing insurance agencies. We are affiliated with SIAA, a network of over 5,000 insurance agencies across the US, who by joining together have increased their strength and stability...

1000 Pine Barren Rd.

Pooler, GA 31322

Phone : 912-330-1265

Email : info@truepointgroup.com

Standards must met the requirements of ASME/ANSI or ASTM

Operated by or for the Federal Government for the benefit of the Armed Forces and their dependents

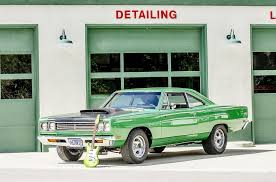

insurance needs. Mechanics, auto body repair shops, and other’s need what is known as Garage Liability Insurance.

insurance needs. Mechanics, auto body repair shops, and other’s need what is known as Garage Liability Insurance.Earlier we noted that Garage Liability covered on-site incidents. Does your business take customer vehicles on test drives? Do you drive customer vehicles to other locations? How about pick-up and delivery of customer vehicles? If your businesses drive customer vehicle off premises, you need a Garagekeepers policy. For more information on Garagekeepers Coverage forms see:

Business Liability insurance can get confusing. That’s why it is important for business owners to do some work on their end. It’s wise to invest some time on the front-end finding a good agent. Working with an independent agent increases your chance of success.

Garage liability covers your customer vehicles. This coverage will not cover you if the vehicle leaves your place of business. Damage that occurs offsite will not be covered. Drive, tow or levitate the car to another location. It doesn’t matter, damages will not be covered. It is not uncommon to see Garage Liability policies with Garagekeepers.

Garage liability covers your customer vehicles. This coverage will not cover you if the vehicle leaves your place of business. Damage that occurs offsite will not be covered. Drive, tow or levitate the car to another location. It doesn’t matter, damages will not be covered. It is not uncommon to see Garage Liability policies with Garagekeepers.