2018 TruePoint Insurance all rights reserved

TruePoint Insurance is one of Georgiaís fastest growing insurance agencies. We are affiliated with SIAA, a network of over 5,000 insurance agencies across the US, who by joining together have increased their strength and stability...

1000 Pine Barren Rd.

Pooler, GA 31322

Phone : 912-330-1265

Email : info@truepointgroup.com

2018 TruePoint Insurance all rights reserved

Insurers commonly provide coverage for mobile/manufactured homes by modifying a conventional homeowner policy with provisions called endorsements. The endorsements change key definitions and other elements of a conventional policy to fit a mobile or manufactured home situation. The result is a modified homeowner package that protects the home, outbuildings (unattached garages, sheds, etc.) and personal property. They also provide insurance for personal liability. Regardless of the type of home you own or live in, it is important that you learn about the coverage options that are available. You may find that different policies vary considerably in coverage and price.

Insurers commonly provide coverage for mobile/manufactured homes by modifying a conventional homeowner policy with provisions called endorsements. The endorsements change key definitions and other elements of a conventional policy to fit a mobile or manufactured home situation. The result is a modified homeowner package that protects the home, outbuildings (unattached garages, sheds, etc.) and personal property. They also provide insurance for personal liability. Regardless of the type of home you own or live in, it is important that you learn about the coverage options that are available. You may find that different policies vary considerably in coverage and price.

Coverage for mobile/manufactured homes is generally offered using two approaches. Some policies include a laundry list of items (or perils) that may cause a loss. Other policies protect your home against everything EXCEPT for a host of specified perils. Either approach includes liability coverage that protects you for injuries or losses to others which you accidentally cause.

Property Insurance Needs

Any coverage option you choose is likely to reflect the fact that mobile homes are, well, mobile. Therefore coverage is affected by the fact that mobile homes:

Any coverage option you choose is likely to reflect the fact that mobile homes are, well, mobile. Therefore coverage is affected by the fact that mobile homes:

The mobility of such homes creates a special need to protect the financial interest of the business that lent the money to purchase the home. For example, a mobile home owner who lives in Ohio decides to drive his home to Arkansas. The soon-to-be Arkansas resident “forgets” to mention his plan (and his new address) to his Ohio Mortgage Company. The Ohio lender would be out of luck if the policy didn’t include protection for this whimsical act. Another way in which a mobile or manufactured homeowner policy differs from conventional homeowner coverage involves coverage for unattached buildings. This coverage is usually minimal for, say, $2,000. Such a provision helps keep the premiums for policies lower by avoiding paying claims on very low-value structures. The coverage is likely to be offered on an actual cash value basis. Unfortunately, mobile and manufactured homes tend to lose value over time.

The policy is likely to include a provision that requires you to get permission to move your home. Once granted, you’re likely to get thirty days of special transportation protection for¬†collision;¬†sinking, upset or stranding (a special, higher deductible may apply during the move). Another common coverage feature is coverage for your attempt to move the home in order to prevent damage from an insured cause of loss. For example, you move your mobile home fifty feet to get away from a neighboring trailer that is on fire. IMPORTANT: coverage for moving endangered property usually has a modest limit (several hundred dollars is typical) because of owners who may be too heroic or clumsy for anyone’s good.

Liability Insurance Needs

The liability protection connected with mobile or manufactured homes is, for all practical purposes, identical to the liability provided to conventional homeowners. Why? The likelihood of guests to be hurt at your home, or your probability of being sued, tends to be the same. The important thing to remember is that your agent is a tremendous source for getting the information you need to be sure that your home and property are adequately protected at a reasonable price.

COPYRIGHT: Insurance Publishing Plus, Inc. 2016

All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

If you‚Äôre like most, replacing your home and personal property are the primary reasons for purchasing a homeowners insurance policy.¬† While that is important, insuring your property may not be the most important coverage offered by your homeowners’ insurance policy.

Insurance claims in Kentucky and many other areas increase during the spring.  Severe weather is the primary culprit of Spring insurance claims.  What would happen if a tree fell on your house during a windstorm and damaged your home?  After you meet your policy deductible, your homeowner’s insurance policy would cover the cost of repairs.

What if the wind had been blowing in the other direction and instead of crashing through your rough, your neighbor’s home is the one damaged.  In most cases, your neighbor’s insurance would cover the damages to his house.

However, there are cases where you are liable.  If the tree was dead, dying, diseased or unstable you could be on the hook.  If you are cutting the tree down, you are liable.

What‚Äôs your liability exposure?¬† ¬†What should your liability limit be?¬† It depends!¬† But one thing is for sure.¬† You need to have input.¬† If you’re being left out of this process, your likely be left out of many other decisions.

No one will deny the importance of communication.  How will things go if you decide not to communicate with your boss?  Even better, your spouse?  Not even an occasional Uh-huh.

Your homeowner’s policy protects you from many¬† ¬†But there are always people that you would rather not talk toMost of us could quickly compile a list of the top ten people that we didn’t want to talk to.¬† If we compiled a list of the people that we least wanted to communicate withYour boss communicates with you, so does your spouse.¬† While at times most of us would The job of the insurance agent would be fairly simple if you were only getting property coverage.¬† How much is your house worth, how much personal property coverage would you like, and what causes of loss do we need to protect against.

Liability exposures are much more difficult to define.  How much will it cost to repair/replace your neighbor’s home in the example provided above?  Do you have adequate personal liability protection?

Liability exposures are much more difficult to define.  How much will it cost to repair/replace your neighbor’s home in the example provided above?  Do you have adequate personal liability protection?

While the claim to repair the neighbor’s home could be very significant, relative to other potential liability exposures, this would be small.  Kids open the door to much larger exposures when their invited and even uninvited friends have access to your pool, trampoline, treehouse, fireworks, go-carts, and more.  How much coverage would you need if an injury or death occurred on your property due to your negligence?

Take some time to review your homeowner’s policy.  The limits on your home will most likely exceed the value of your home and personal property.  Can you say the same about your liability limits?  Finally, speak to a qualified insurance broker that can provide you guidance.  The last thing you need is for someone that can sell you insurance, what you truly need is an individual that can work with you in developing a compressive risk management plan.

Tree houses are prime elements of childhood fun. They are clubhouses, hideaways, castles, war rooms, forts, spaceships, control centers, submarines; the list of what they can perform is limited only by imagination.

Tree houses are prime elements of childhood fun. They are clubhouses, hideaways, castles, war rooms, forts, spaceships, control centers, submarines; the list of what they can perform is limited only by imagination.

Now let’s look at a tree house with an insurance company’s eyes….oh boy! Now we have a structure with a separate value that, just like a home, garage, shed, or pool; needs specific coverage. Worse, that coverage has to be for damage to the tree house as well as for protection against losses caused by owning a tree house.

The fact that tree houses are so fun is what makes them a big problem, insurance-wise! They are attractive nuisances, which is to say, Child Magnets! Tree houses are guaranteed to make a home popular, very popular! And the word of one will spread far and wide!

The fun provided by tree houses has to be tempered by the following:

Besides the above, consider when the household’s kids have outgrown the tree house and the owners pay even less attention to it. Depending on the location, it could even attract illegal activity!

If you have a tree house, make sure that it’s maintained and activities are supervised. Also, make sure you get an insurance professional’s help in getting protection….or else all of the fun disappears!

COPYRIGHT: Insurance Publishing Plus, Inc.  2014

All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

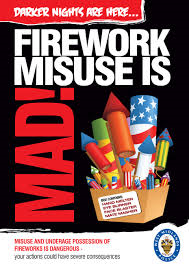

In part one we discussed that a homeowners policy may be available to handle losses involving fireworks. However, this is not

always the case as there are instances where your homeowner policy does not offer coverage.

Legal Issue

If it’s illegal for you to set off fireworks, this legal hurdle could result in any loss being excluded by the policy.

Business Issue

A homeowners policy is meant to handle losses related to owning and living in a home, there’s no coverage for a person who uses their home for making, selling, storing or distributing fireworks. Any business activity involving fireworks is going to cause a big problem if a loss occurs.

Who Is Injured Issue

Injuries to yourself or others in your household are not covered because Medical Payments and Liability coverage is designed to handle loss suffered by persons outside of your household.

Intentional Loss Issue

If an injury or damage to property is not an accident, there’s no coverage. Tossing a firecracker or aiming a bottle rocket at another person could be considered deliberate, even when no injury was intended. Deliberate acts and their consequences are commonly excluded by homeowners policies.

So when dealing with fireworks, make sure they’re legal, that they’re used carefully and only for entertainment. Then your chances are good that any loss may also be covered.

COPYRIGHT: Insurance Publishing Plus, Inc. 2016 All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

¬†Fireworks Accidents ‚Äď Part 1 of 2¬† ¬†

A longtime, extremely popular summer rite is to enjoy setting off fireworks. However, it’s important to think, truly think, before striking a match or using a lighter on your first firecracker, sparkler, smoke-bomb, bottle rocket or other forms of incendiary entertainment. For all their fun, fireworks are capable of causing serious injuries to persons and substantial damage

A longtime, extremely popular summer rite is to enjoy setting off fireworks. However, it’s important to think, truly think, before striking a match or using a lighter on your first firecracker, sparkler, smoke-bomb, bottle rocket or other forms of incendiary entertainment. For all their fun, fireworks are capable of causing serious injuries to persons and substantial damage to property. Such losses can have substantial financial consequences, so it’s important to know whether you are insured in the event you cause a fireworks accident.

to property. Such losses can have substantial financial consequences, so it’s important to know whether you are insured in the event you cause a fireworks accident.

Examples:

Imagine you are setting off some fireworks in your driveway for your children and their friends. Suddenly, a sparkler you gave to a neighbor’s child violently flares up, burning her hand and face.

While setting off some bottle rockets, one smashes through a window of a house across the street. The rocket sets the home’s living room curtains on fire. It then spreads to the carpeting and the room’s furnishings. The local fire department responds, putting out the fire. There are thousands of dollars in damage caused by fire and water.

While setting off some bottle rockets, one smashes through a window of a house across the street. The rocket sets the home’s living room curtains on fire. It then spreads to the carpeting and the room’s furnishings. The local fire department responds, putting out the fire. There are thousands of dollars in damage caused by fire and water.

In the first example, your Homeowners Policy could cover her injuries a couple of ways. If the injuries are minor, her medical  treatment could be handled under the Medical Payments portion. However, if the child’s injuries are more serious and her parents sue, your policy’s liability portion should handle your legal defense as well as a legal judgment.

treatment could be handled under the Medical Payments portion. However, if the child’s injuries are more serious and her parents sue, your policy’s liability portion should handle your legal defense as well as a legal judgment.

In the latter example, one could be found negligent for causing the fire and subsequent damage. A homeowners policy usually handles claims such as these. However, you should also be aware of the limitations which will be covered in part two of this topic.

Continue to section 2

COPYRIGHT: Insurance Publishing Plus, Inc. 2016 All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

http://www.insuringky.com

Welcome to

Thank you for choosing us for your insurance needs! It is our commitment to provide our clients with quality insurance products at a great price, and we are so pleased to have you as a new customer! As you may have already discovered, we offer real-time quotes on our website, payments over the phone, and E-signature options for most documents. Did you know you can also print ID Cards directly from our website? Of course, we always enjoy meeting and seeing our customers face to face! However, we understand your time is valuable, so we offer electronic options, as well as two office locations in order to accommodate your schedule. We have expanded our service team, as well, and look forward to helping you protect what is valuable to you!

OUR SERVICE TEAM:

6287 Taylorsville Rd.             1085 Eagle Lake Drive

Fisherville, KY  40023           Lawrenceburg, KY  40342

PHONE: (502)410-5089

PHONE: (502)410-5089

Jordan Milburn, ext. 105                                                                                                                                     Jessica Coleman, ext. 120

Licensed Service Specialist                                                                                                                                   Director of Client Services

CLIENT LIAISON                                                                                                                                              ACCOUNT EXECUTIVE

jordan.milburn@truepointgroup.com                                                                                                               jessica.coleman@truepointgroup.com

Jordan will likely be your first point of contact when you call. She is a licensed P&C Agent, and her primary responsibility is to ensure your satisfaction. From providing proof of insurance, taking payments, and processing policy changes to quoting/issuing new policies, she can often handle your requests quickly and efficiently (or direct you to the most effective resource available).

Jessica will be in the Lawrenceburg office from 8:30-4:30, M-F. She will coordinate with Jordan to ensure our agency is meeting the needs of our clients. As the Director of Client Services, she will be happy to review your policy at each renewal, and make sure you are receiving all of the discounts and coverage options available to you. You can call or email her to schedule your personal policy review. Also, if things change in your life (and they usually do), don’t forget to call and tell us! We want to keep you covered correctly! And if the worst should happen, and you need to file a claim, Jessica will gladly help you through the filing process for the quickest resolution possible.

They are both committed to giving you amazing service, and looking forward to working with you.

Please let us know if you have any questions about your new policy, or if you would like for us to quote another type of insurance for you. We appreciate your business!

Sincerely,

Brad and Kristen Smith

P.S. If you are happy with your service, Like, Share, or Leave a Review!  We’d love to hear your thoughts!

Homesharing has been a ‚Äúthing‚ÄĚ for years and its use is growing along with internet applications that facilitate transactions involving making a residence available for short-term rentals. Standard homeowner policies have long been issued under the assumption that a covered residence is usually occupied by the named insured and that person‚Äôs family on a full-time basis.

While insurance policies issued for homes, condos, and apartments do contemplate some situations involving other persons staying in a residence, those situations are allowable when they don’t involve financial transactions. Renting for income alters a residential situation into a business. Business activity creates a coverage problem which could result in policies being canceled or claims being denied. Renting all our part of a residence also results in types of losses that are uncovered because they haven’t been contemplated as insurable, residential activities.

Policy wording may exclude coverage for losses when they are directly related to a business. So, protection may be lost for the residence, residential property as well as for liability for damage or injury to others and their property.

Basic HO policies, if they don’t outright exclude losses involve compensated rentals, severely restrict other coverage. However, due to the rising popularity of homesharing, the insurance market is responding with options to provide more protection. A basic policy may be amended to extend protection which does the following:

However, this additional protection may still fall short of what is needed. The insurance market is now making broader coverage available that handles less common exposures such as ID theft resulting from homesharing, pest infestation caused by renters, liquor liability coverage arising from alcohol served during rentals, extra cost caused by excessive use of utilities, or personal and advertising liability.

Even with special coverage for homesharing, property owners should also be aware of consequences and cost of resolving issues such as breaking local zoning laws, violating residential association bylaws or legal costs of dealing with squatting situations. Homesharing is a popular component of the sharing economy, but participants need to be careful to get proper protection.

Return to Part 1

COPYRIGHT: Insurance Publishing Plus, Inc. 2018 All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

For a variety of reasons, changing attitudes, objectives and financial situations have created interest in collaborative consumption and the growth in the sharing economy. Homesharing and ridesharing have become major components in this evolving economy. The term can be confusing and have more than one meaning.

Regarding this article, we are discussing commercial arrangements represented by services such as AirBnB. Its premise is to match supply and demand for housing related to traveling. It allows a resident of a home, condo or apartment in one location to provide short-term housing to persons traveling through or vacationing in their locale. The arrangement is facilitated through an online platform that provides the obligations of both parties to the transaction. Therefore, this discussion does not involve situations involving short-term trading or swapping of property in exchange for either similar residential space or in exchange for providing skills or services.

A wide variety of rental situations fall under homesharing, such as the following:

The online aspect is critical as it acts as a portal for providing information on available residences, locations of property, property features, rental costs, available amenities, contractual obligations related to property use and payment of fees, deposits, and, if necessary, damages or penalties due to misuse.

A major motivation for such homesharing arrangements is the opportunity of significant, additional income for underutilized property. However, that creates a problem. What coverage issues exist under residential insurance policies?

COPYRIGHT: Insurance Publishing Plus, Inc. 2018 All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.