In part one of this article, we discussed the situation of properly classifying workers. In this part, we discuss a method for making that distinction.

In part one of this article, we discussed the situation of properly classifying workers. In this part, we discuss a method for making that distinction.

In the U.S., common law helps determine worker status. Some confusion is created by improper focus on a given work relationship. Instead of a narrow focus, proper worker classification is a result of looking at the total work situation in which an individual performs a job. Essentially, classification is a matter of control. Specifically, consider the following areas:

Behavioral РWho has primary control over how work is done, the business or the worker?

Financial РWho controls how a worker is paid, how are expenses handled, who is responsible for supplies and tools that are needed for work?

Relationship РWhat defines the work relationship, manner of pay, what benefits are in place, does worker have paid vacation and what is the nature of the relationship?

It’s important that all the above factors be considered when evaluating a worker classification.

Evaluation should be performed on a simple scale. The greater the control by a given party determines how to make a classification. If a business exerts the greater overall control, the worker is an employee. If the individual worker exerts the greater overall control, the worker is an independent contractor.

Practically speaking, areas of control involve the level of freedom a worker has in getting tasks done, but  another element is the nature of the work. Some businesses want to minimize both their tax liability and legal liability (and related payroll costs) by use of independent contractors. However, the situation can’t be a façade. If workers have an ongoing relationship with the applicable business because the work is normal for that business, likely the work involves employees. When the work is unusual for the given business and lasts for a short period, especially when it involves specialize labor or skills not existing in that business, the work likely involves independent contractors.

another element is the nature of the work. Some businesses want to minimize both their tax liability and legal liability (and related payroll costs) by use of independent contractors. However, the situation can’t be a façade. If workers have an ongoing relationship with the applicable business because the work is normal for that business, likely the work involves employees. When the work is unusual for the given business and lasts for a short period, especially when it involves specialize labor or skills not existing in that business, the work likely involves independent contractors.

If a business or a worker is unclear over a classification, help is available from the IRS. Specifically, a work situation description can be submitted to the IRS to get its interpretation. Having that department’s help (and documentation) for a situation could be quite helpful in dealing with both tax and insurance matters.

Return to Section 1

COPYRIGHT: Insurance Publishing Plus, Inc. 2018

All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

![]()

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions

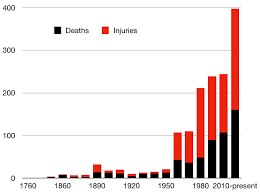

Tragedy is often the precursor of innovation.  It certainly was during WW II.  It also drives changes and the creation of new products in the insurance industry.  The insurance sector exists because individuals, businesses and other entities have a need to transfer risks to another party.  Increasing active shooter incidents in recent years and the corresponding legal actions have created demand for products that can provide financial protection.

Tragedy is often the precursor of innovation.  It certainly was during WW II.  It also drives changes and the creation of new products in the insurance industry.  The insurance sector exists because individuals, businesses and other entities have a need to transfer risks to another party.  Increasing active shooter incidents in recent years and the corresponding legal actions have created demand for products that can provide financial protection. industry will over time and after numerous assessments develop standards that when deployed will ward off many would be active shooters.  They work for insurance companies will also work to reduce the after effects and of course provide financial relief.

industry will over time and after numerous assessments develop standards that when deployed will ward off many would be active shooters.  They work for insurance companies will also work to reduce the after effects and of course provide financial relief.

In part one of this article, we discussed the situation of properly classifying workers. In this part, we discuss a method for making that distinction.

In part one of this article, we discussed the situation of properly classifying workers. In this part, we discuss a method for making that distinction. another element is the nature of the work. Some businesses want to minimize both their tax liability and legal liability (and related payroll costs) by use of independent contractors. However, the situation can’t be a façade. If workers have an ongoing relationship with the applicable business because the work is normal for that business, likely the work involves employees. When the work is unusual for the given business and lasts for a short period, especially when it involves specialize labor or skills not existing in that business, the work likely involves independent contractors.

another element is the nature of the work. Some businesses want to minimize both their tax liability and legal liability (and related payroll costs) by use of independent contractors. However, the situation can‚Äôt be a fa√ßade. If workers have an ongoing relationship with the applicable business because the work is normal for that business, likely the work involves employees. When the work is unusual for the given business and lasts for a short period, especially when it involves specialize labor or skills not existing in that business, the work likely involves independent contractors. RVs mean time spent with family and friends on the open road. They represent adventures and the opportunity to develop lasting memories of time together. Just as you are required to insure your regular vehicle, you are also required by law to carry insurance on your RV. The situation that an RV represents is different than a normal vehicle and your insurance needs will also be different as well. Consider this; an RV is both a vehicle and a vacation home. When you are looking at various insurance options, it’s important to consider the pitfalls that you could encounter while you are away from home. The team at TruePoint Insurance serves the needs of Kentucky, Indiana, and Tennessee residents. They understand the

RVs mean time spent with family and friends on the open road. They represent adventures and the opportunity to develop lasting memories of time together. Just as you are required to insure your regular vehicle, you are also required by law to carry insurance on your RV. The situation that an RV represents is different than a normal vehicle and your insurance needs will also be different as well. Consider this; an RV is both a vehicle and a vacation home. When you are looking at various insurance options, it’s important to consider the pitfalls that you could encounter while you are away from home. The team at TruePoint Insurance serves the needs of Kentucky, Indiana, and Tennessee residents. They understand the  Ok, that’s a bit of a stretch.¬† I pretty sure your insurance will not cover you that far away from home.¬† So how far can you go and still have RV Insurance coverage?

Ok, that’s a bit of a stretch.¬† I pretty sure your insurance will not cover you that far away from home.¬† So how far can you go and still have RV Insurance coverage?

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.