Unlike accidental events that result in a person suffering a serious injury (called bodily injury) or property that is damaged or destroyed (called property damage), personal injury usually involves one person’s alleged interference with another person’s legal rights. It also applies to incidents that harm another person’s reputation.

Personal Injury commonly includes acts such as the following:

False arrest, detention or imprisonment

Example: A homeowner suspects that her teen daughter’s friend has stolen jewelry while visiting her home. She locks the teen in her bedroom for an hour until the police arrive and it turns out the teen did nothing wrong.

Malicious prosecution

Example: A gentleman accuses his neighbor of stealing a laptop from his home and files charges with the police. After investigating the matter, the police discover that the lap top owner had sold the property and made the accusation because the neighbors had been feuding over an unrelated matter.

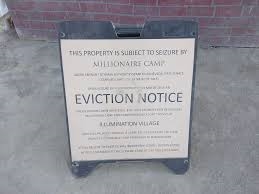

Wrongful eviction from, wrongful entry into, or invasion of the right of private occupancy

Example: A boarder comes home from work and finds his room’s door padlocked. The homeowner/landlord did it after the boarder, for the third night in a row, played his CD system too loudly. The boarder is forced to leave the premises that same night.

Oral or written publication of material that slanders or libels a person or organization or disparages a person’s or organization’s goods, products or services

Example: A homeowner is the president of a parent and school organization. She also publishes articles for the organization on her personal website, but is widely followed by members in the parent and school organization. After an argument with another organization officer, the president recounts the incident on her site and includes some crude insults and false items about that person.

Oral or written publication of material that violates a person’s right of privacy

Example: A woman is visiting a friend. During the visit, she overhears her friend’s conversation with her doctor. The next day, the person reveals to others that the friend, a young, single female, is having medical problems due to an unexpected pregnancy.

All such acts are examples of incidents that could result in lawsuits. However, they are also the sort of events that are excluded from coverage by the typical homeowners policy. The major reason for their exclusion is that they are deliberate acts rather than being accidental. One way to secure coverage for personal injury losses is to purchase personal umbrella coverage. It may be worthwhile to discuss your possible need for personal injury coverage with an insurance professional.

COPYRIGHT: Insurance Publishing Plus, Inc. 2015

All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without the written consent of Insurance Publishing Plus, Inc

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions

If you have a mortgage and your home is located in an area that has been identified by FEMA as a flood zone, chances are, you have been notified that

If you have a mortgage and your home is located in an area that has been identified by FEMA as a flood zone, chances are, you have been notified that  Whether you live in Louisville or Lexington or the surrounding communities, you’ll have no trouble finding a great body of water. The Kentucky River, Ohio River, Mississippi River, and many other’s present awesome waterways for Kentucky boaters.

Whether you live in Louisville or Lexington or the surrounding communities, you’ll have no trouble finding a great body of water. The Kentucky River, Ohio River, Mississippi River, and many other’s present awesome waterways for Kentucky boaters. But before deciding to forgo watercraft boat insurance, first, consider what you paid for the boat. Now think how many opportunities there are for severely damaging your boat. On the way to the lake, you can relax a bit. As long as the boat is on a trailer being towed by your insurance truck or car, the liability exposure of the boat will be picked up by your auto insurance. Once off the trailer, the boat is your responsibility. During the process of unloading your boat, it’s possible for you to damage another boat. Just as easily you might also damage their truck, trailer, or even worse, another person. Once on the lake, there is an unlimited supply of exposures. Any of which might damage your boat. Damaging your boat and losing your entire investment would be bad enough, but if you are involved in an accident with another boat, you could potentially be out a boat plus buying a new one for the other party.

But before deciding to forgo watercraft boat insurance, first, consider what you paid for the boat. Now think how many opportunities there are for severely damaging your boat. On the way to the lake, you can relax a bit. As long as the boat is on a trailer being towed by your insurance truck or car, the liability exposure of the boat will be picked up by your auto insurance. Once off the trailer, the boat is your responsibility. During the process of unloading your boat, it’s possible for you to damage another boat. Just as easily you might also damage their truck, trailer, or even worse, another person. Once on the lake, there is an unlimited supply of exposures. Any of which might damage your boat. Damaging your boat and losing your entire investment would be bad enough, but if you are involved in an accident with another boat, you could potentially be out a boat plus buying a new one for the other party. If you’re able to take the watercraft out onto the water, then it can be protected with a form of boat insurance. Whether you have a bass boat or you have a houseboat you like to take out on the lake,

If you’re able to take the watercraft out onto the water, then it can be protected with a form of boat insurance. Whether you have a bass boat or you have a houseboat you like to take out on the lake,  accident on your way to the lake, on the lake, or even inside of your garage, may put your purchase at financial risk, and can even put you at risk of paying out due to liability issues. It’s easy to find out what kind of coverage options are available for Kentucky boat owners. All you need to do is give the team at TruePoint Insurance a call today.

accident on your way to the lake, on the lake, or even inside of your garage, may put your purchase at financial risk, and can even put you at risk of paying out due to liability issues. It’s easy to find out what kind of coverage options are available for Kentucky boat owners. All you need to do is give the team at TruePoint Insurance a call today. The staff at TruePoint Insurance in Fisherville, KY knows that the truth about what you need with insurance is the most important factor. The staffers here are honest and will tell you exactly what is necessary to make your motorhome experience the very best that it can be. You’ve taken the plunge. You’ve purchased the motorhome. Now, how do you best protect it?

The staff at TruePoint Insurance in Fisherville, KY knows that the truth about what you need with insurance is the most important factor. The staffers here are honest and will tell you exactly what is necessary to make your motorhome experience the very best that it can be. You’ve taken the plunge. You’ve purchased the motorhome. Now, how do you best protect it?

state? How often will you be driving out of state or internationally?

state? How often will you be driving out of state or internationally?

Autumn is noted for the color and delight found in the changing of the seasons! But change also arrives in the form of the colorful masses that gather and celebrate…..around football stadiums. It happens around high school games on Friday nights and on crisp cool Saturdays around colleges and universities. It happens on Sunday afternoons, Sunday Nights, Monday Nights and all the other times that they squeeze in days and times for professional football. From amateur to professional contests, upwards of 50 million people annually enjoy tailgating.

Autumn is noted for the color and delight found in the changing of the seasons! But change also arrives in the form of the colorful masses that gather and celebrate…..around football stadiums. It happens around high school games on Friday nights and on crisp cool Saturdays around colleges and universities. It happens on Sunday afternoons, Sunday Nights, Monday Nights and all the other times that they squeeze in days and times for professional football. From amateur to professional contests, upwards of 50 million people annually enjoy tailgating. lowering vehicle tailgates and enjoying food, drinks and recreational activities! Tailgating began simply enough with socializing among folks who came to game locations early enough to secure scarce parking. The socialization was enhanced by food and drinks, then the events became more elaborate involving bring your own pitch-ins, barbecues, concerts, recreational sports, etc.

lowering vehicle tailgates and enjoying food, drinks and recreational activities! Tailgating began simply enough with socializing among folks who came to game locations early enough to secure scarce parking. The socialization was enhanced by food and drinks, then the events became more elaborate involving bring your own pitch-ins, barbecues, concerts, recreational sports, etc.

RVs mean time spent with family and friends on the open road. They represent adventures and the opportunity to develop lasting memories of time together. Just as you are required to insure your regular vehicle, you are also required by law to carry insurance on your RV. The situation that an RV represents is different than a normal vehicle and your insurance needs will also be different as well. Consider this; an RV is both a vehicle and a vacation home. When you are looking at various insurance options, it’s important to consider the pitfalls that you could encounter while you are away from home. The team at TruePoint Insurance serves the needs of Kentucky, Indiana, and Tennessee residents. They understand the

RVs mean time spent with family and friends on the open road. They represent adventures and the opportunity to develop lasting memories of time together. Just as you are required to insure your regular vehicle, you are also required by law to carry insurance on your RV. The situation that an RV represents is different than a normal vehicle and your insurance needs will also be different as well. Consider this; an RV is both a vehicle and a vacation home. When you are looking at various insurance options, it’s important to consider the pitfalls that you could encounter while you are away from home. The team at TruePoint Insurance serves the needs of Kentucky, Indiana, and Tennessee residents. They understand the  Ok, that’s a bit of a stretch. I pretty sure your insurance will not cover you that far away from home. So how far can you go and still have RV Insurance coverage?

Ok, that’s a bit of a stretch. I pretty sure your insurance will not cover you that far away from home. So how far can you go and still have RV Insurance coverage?