The Greatest Tragedy of our Generation

I’ve heard that tragedy defines us.  I disagree with that; it is how we as a group rise and address adversity that defines us.  An excellent example is my grandfather’s generation.  They’ve been referred to as the Greatest Generation, a fitting accolade to the group that defended our freedom and won WW II.

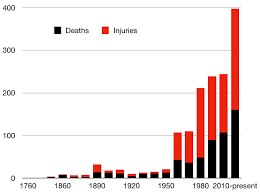

What is the great tragedy of our generation?  Is it global warming?  It could be the rise of terrorism!  While I can’t answer the question, I do know that school shootings and other active shooter related incidents have to be somewhere in the mix.

Tragedy is often the precursor of innovation.  It certainly was during WW II.  It also drives changes and the creation of new products in the insurance industry.  The insurance sector exists because individuals, businesses and other entities have a need to transfer risks to another party.  Increasing active shooter incidents in recent years and the corresponding legal actions have created demand for products that can provide financial protection.

Tragedy is often the precursor of innovation.  It certainly was during WW II.  It also drives changes and the creation of new products in the insurance industry.  The insurance sector exists because individuals, businesses and other entities have a need to transfer risks to another party.  Increasing active shooter incidents in recent years and the corresponding legal actions have created demand for products that can provide financial protection.

The insurance industry is actively working to develop products that will protect businesses, schools and other government entities from gaps in current insurance policies.  Professional liability policies were not designed to protect against active shooter risk or anything similar to that.

So what can be done and how do we do it?  Products have been created and will continue to improve that will offer financial protection to entities that have been accused of failing to adequately prepare.  But there is more.

Insurance companies seldom get the respect that they deserve; however, behind the scenes they are making a difference.  The insurance industry is much more than a financial risk transfer vehicle, insurance companies are the leaders in making our world a safer place to leave.  While most of us will never understand the significance, the insurance industry will lead America’s efforts as we deal with the risk of loss of life, mental trauma, and financial loss associated with active shooter incidents.

How?  Who understands risk as well as the insurance industry?  The better we understand risk exposures, the better we can prepare.  The insurance  industry will over time and after numerous assessments develop standards that when deployed will ward off many would be active shooters.  They work for insurance companies will also work to reduce the after effects and of course provide financial relief.

industry will over time and after numerous assessments develop standards that when deployed will ward off many would be active shooters.  They work for insurance companies will also work to reduce the after effects and of course provide financial relief.

The insurance industry is working to make our world safer.  If you are interested in learning more about the insurance industries role in managing active shooter risk you are more than welcome to contact us:

by email: info@truepointgroup.com

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.

insurance needs.

insurance needs.

Garage liability covers your customer vehicles. This coverage will not cover you if the vehicle leaves your place of business. Damage that occurs offsite will not

Garage liability covers your customer vehicles. This coverage will not cover you if the vehicle leaves your place of business. Damage that occurs offsite will not